More Corporate Sustainability reporting …

6th September 2023

Just before the 2023 holiday season got underway, the first two sustainability accounting/reporting standards, IFRS S1 and S2 were published by the ISSB, formalising the first output of the TCFD (the glossay below explains who the various bodies are). The requirement for corporate sustainability reporting – already underway for some time, marches on.

It’s easy to feel swamped by the array of sustainability and climate-risk disclosures being asked of companies, and unless you are in the large/quoted company bracket, they are not necessarily mandatory so it is tempting to ignore them. However, at Klere we take the view that sustainability is something that is relevant to all companies large and small, and that measuring and disclosing are beneficial for a several reasons.

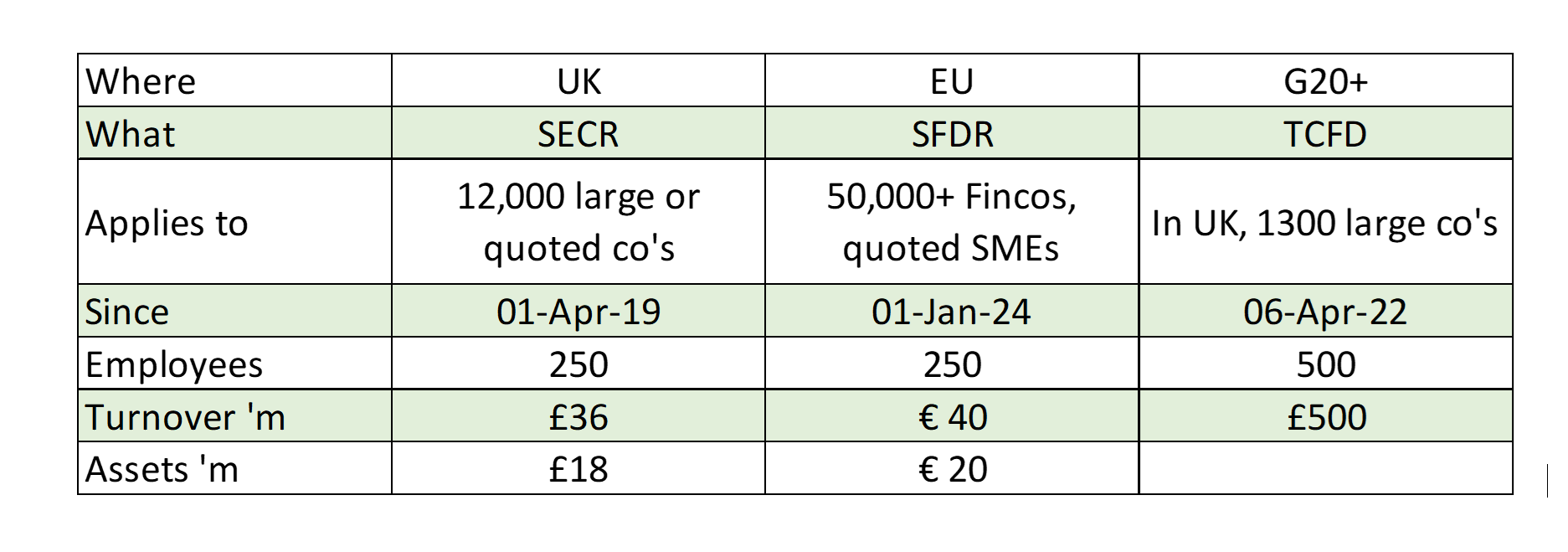

The relevant regulations in our orbit are three: the SECR (UK), SFDR (EU), and TCFD (global). The reporting thresholds are similar but not identical (see chart). The expectation is that the thresholds will be progressively lowered, capturing more of the 36,000 UK companies in the 50-250 employee bracket.

It makes sense to link sustainability messaging, which most firms are already engaged in, to the data required in a formal report: adopting a rigorous approach is a sound business discipline. It is one thing to talk a net-zero target; quite another to have a credible strategy and set of actions that justify the claim. Sustainability, and reporting, must be credible.

The four main reasons for non-financial reporting are usually summarised as:

- Mandatory reporting requirements

- Responding to customers (B2B customers increasingly want to know their Scope 3 supply chain emissions – the carbon embedded in your supply)

- Responding to employees

- Investibility

Investibility is central to the PE/VC sector: funds devote increasing attention to ESG scoring. They want to know where their investments sit on the sustainability spectrum.

By following a recognised and standardised reporting pathway, a PE portfolio acquires rateability. Of the three main reporting platforms – the GRI, the CPD, and the TCFD (reporting now under the ISSB) – Klere uses the GRI, which provides a focus on actionable strategies to achieve carbon and wider ESG targets.

Posted by John Rowley-Conwy

06-09-23

Glossary: international bodies and their relationship:

IFRS – International Financial Reporting Standards

IASB – International Accounting Standards Board (develops the standards)

ISSB – International Sustainable Standards Board (announced at COP26, sister organisation to IASB, global, industry specific climate disclosures)

SASB – Sustainable Accounting Standards Board (USA, established earlier, converging with ISSB)

TCFD – Task Force on Climate Related Financial Disclosure: 4,000 “supporter” companies and organisations worldwide

FSB – Financial Stability Board, Basel; set up the TCFD in December 2015.